Structure Courses are divided into modules. You will normally take modules totalling 180 credits. Required Modules You are required to take: • Quantitative Techniques (15 credits) • Investments Analysis (15 credits) • Applied Corporate Finance (15 credits) • Financial Markets & Institutions (15 credits) • Asset Pricing (15 credits) • Dissertation (60 credits) Optional Modules In addition, you are required to take 45 credits from a range of optional modules that may typically include: • Financial Derivatives (15 credits) • Empirical Finance (15 credits) • Risk Management (15 credits) • Financial Econometrics (15 credits) • Corporate Finance (15 credits) • Banking Regulation (15 credits) • Topics in Applied Finance (15 credits) • Behavioual Finance (15 credits) • Applied Welath Management (15 credits) • International Finance (15 credits) • Financial Engineering (15 credits) • Portfolio Management (15 credits) • Commercial & Investment Banking (15 credits) • Credit Ratings (15 credits) • Computational Finance (15 credits) • Bond Markets, Analysis and Strategies (15 credits) King’s College London reviews the modules offered on a regular basis to provide up-to-date, innovative and relevant programmes of study. Therefore, modules offered may change. We suggest you keep an eye on the course finder on our website for updates.

日本

日本

韩国

韩国

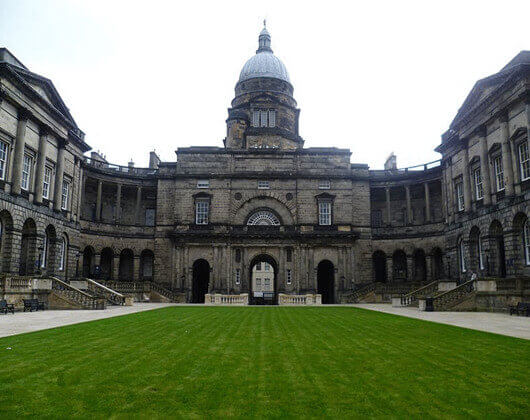

英国

英国